Does Td Ameritrade Have Auto Invest

Are separate unaffiliated entities not responsible for each others services or products. Online brokers Ally Invest and TD Ameritrade both have solid features for new and advanced investors though TD Ameritrade has the edge.

When looking at TD Ameritrade in comparison to competitors like Schwab Robinhood and M1 Finance users will find that TD Ameritrade stands out in a number of areas.

Does td ameritrade have auto invest. Robinhood does come up short compared with TD Ameritrade when it comes to diversity of products and physical branch presence. From goal-oriented solutions to portfolio management with a more personal touch the professionals at TD Ameritrade Investment Management LLC will recommend a portfolio based on your financial goals. I setup auto-sweep from HSABank - TD for anything over 5000 to avoid minimum account fees HSABank.

And TD Bank NA. Between the Android and Apple app stores users have rated TD Ameritrade Mobile at 35 stars and TD Ameritrade Trader at 42 stars. TD Ameritrade is best for active traders looking for multiple trading platforms and tools.

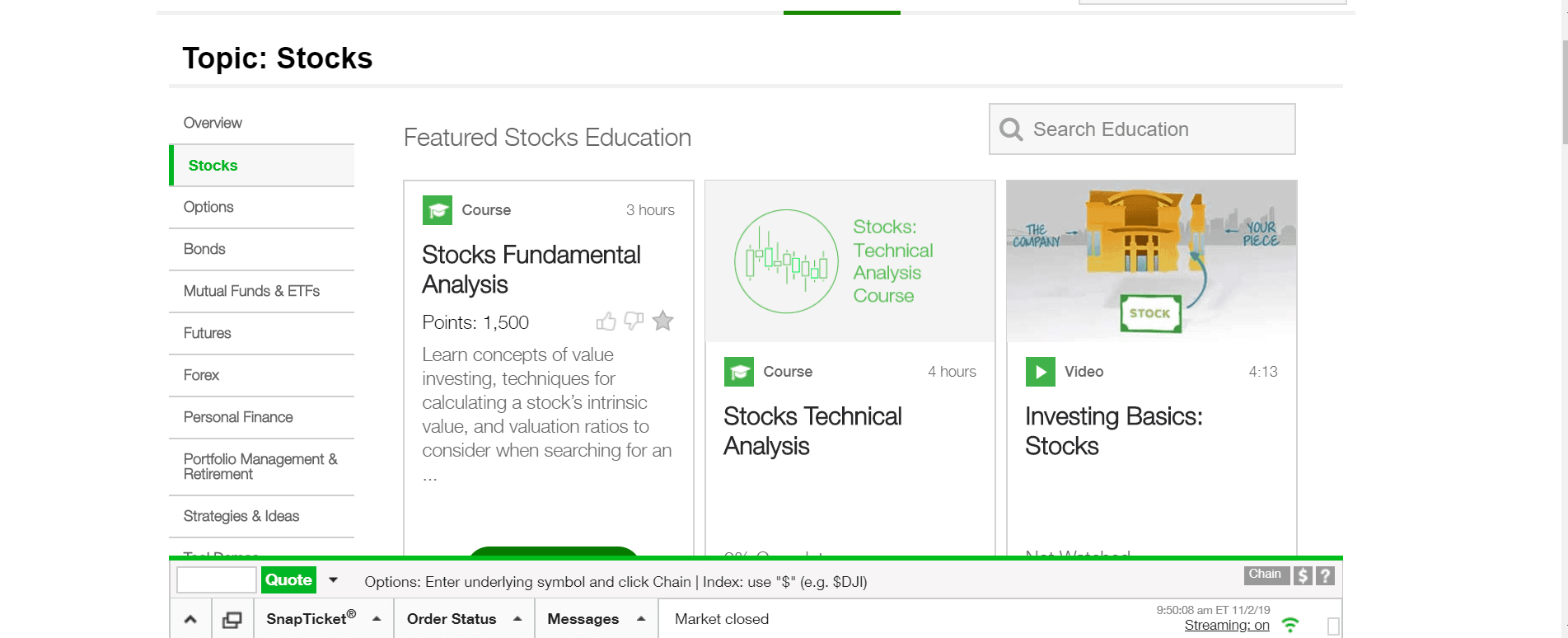

TD Ameritrade is a solid choice for investors who want to begin investing online with no minimum investment and no lengthy hassles to open an account. TD Ameritrade offers plenty of options for investor education including a risk-free paper trading platform that allows users to practice by trading virtual money. Customer Support As one of the largest investment organizations in the US TD Ameritrade has the resources on-hand to set up an extensive customer support network and it doesnt disappoint.

And The Toronto-Dominion Bank. Judgment Investors who are interested in fixed-income products definitely have a good selection at TD Ameritrade. The broker currently has more than 13000 mutual funds.

Investors can trade some. At Vanguard there is a 10000 minimum investment amount for munis which is quite a bit higher than TD Ameritrades 5000 minimum. Set-up auto investments into that mutual fund.

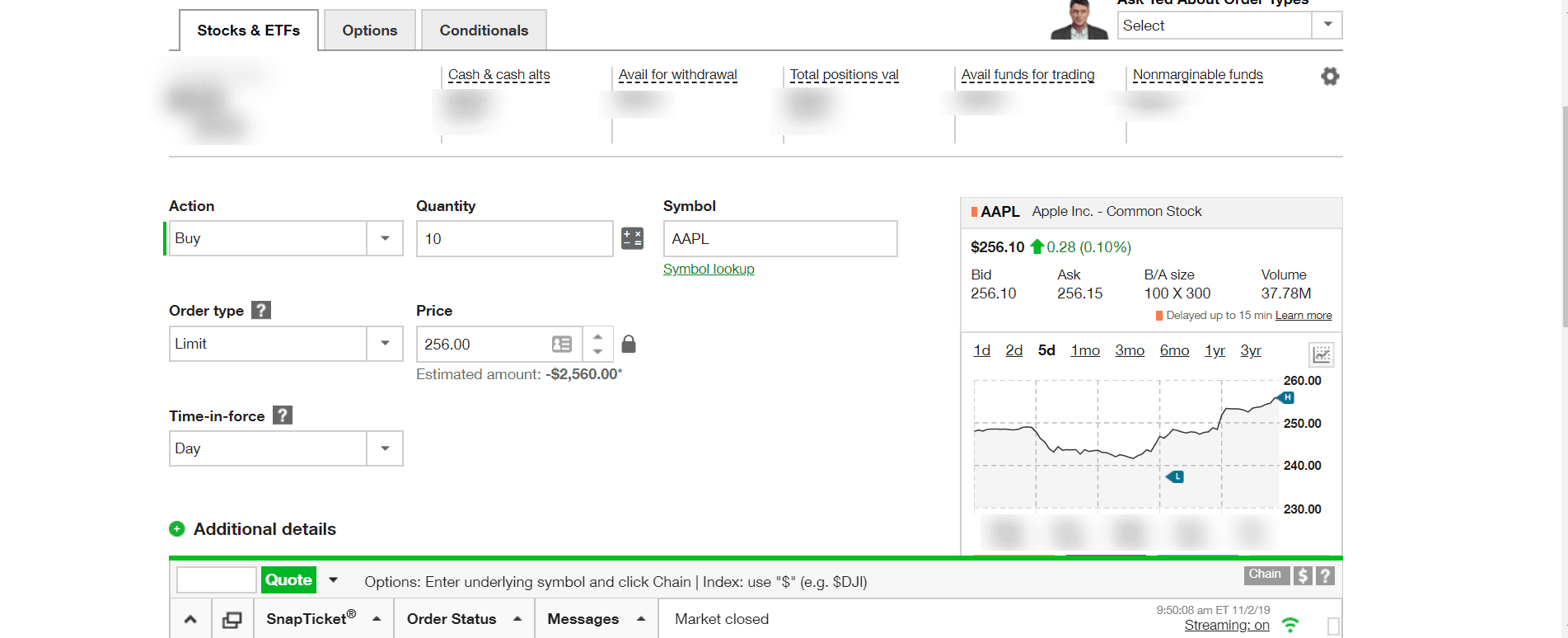

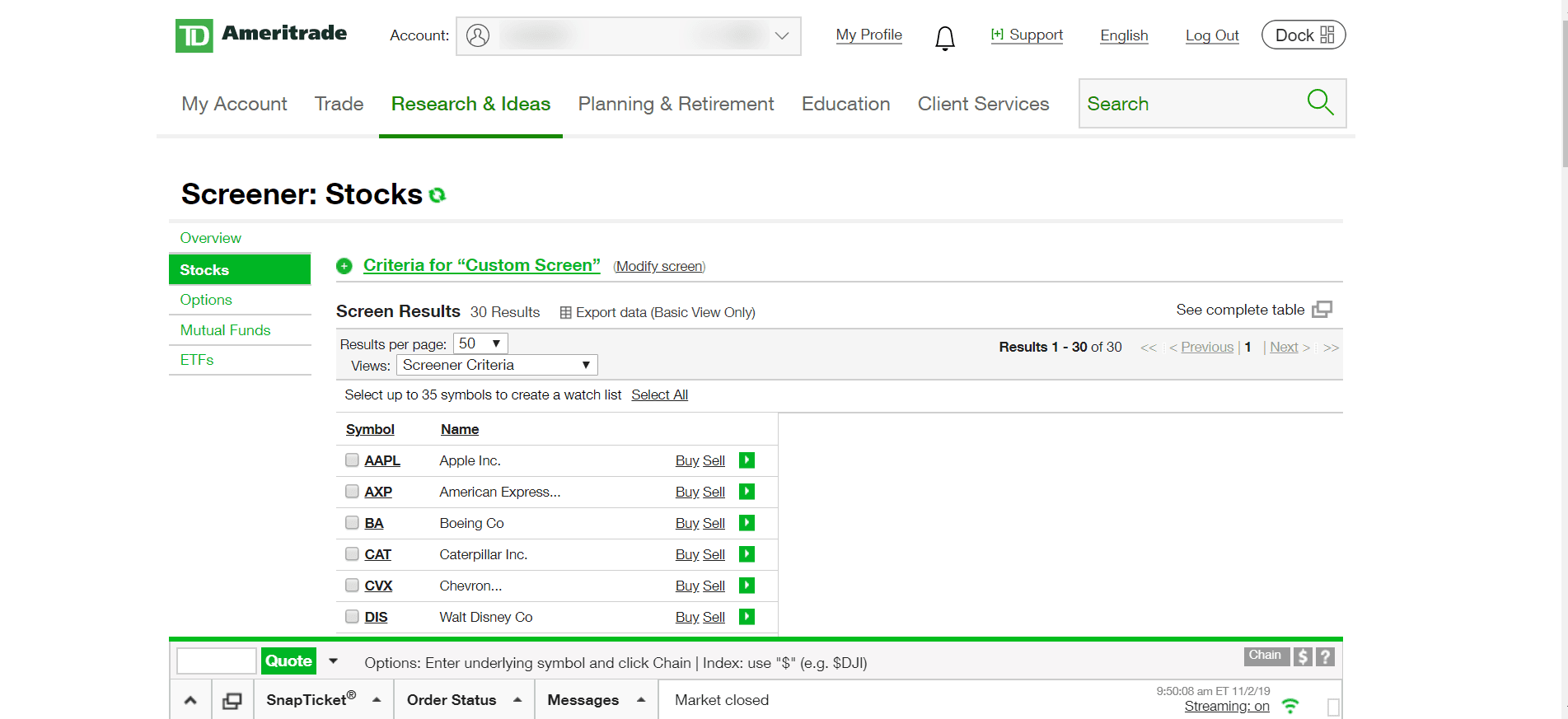

You must first purchase a mutual fund any fund If it is a No Load Mutual Fund there is a 25 cost per fund. Here are instructions on how to set-up auto investments directly into Mutual Funds at TD Ameritrade. TD Ameritrade was founded in 1975 and is one of the biggest US-based stockbrokers.

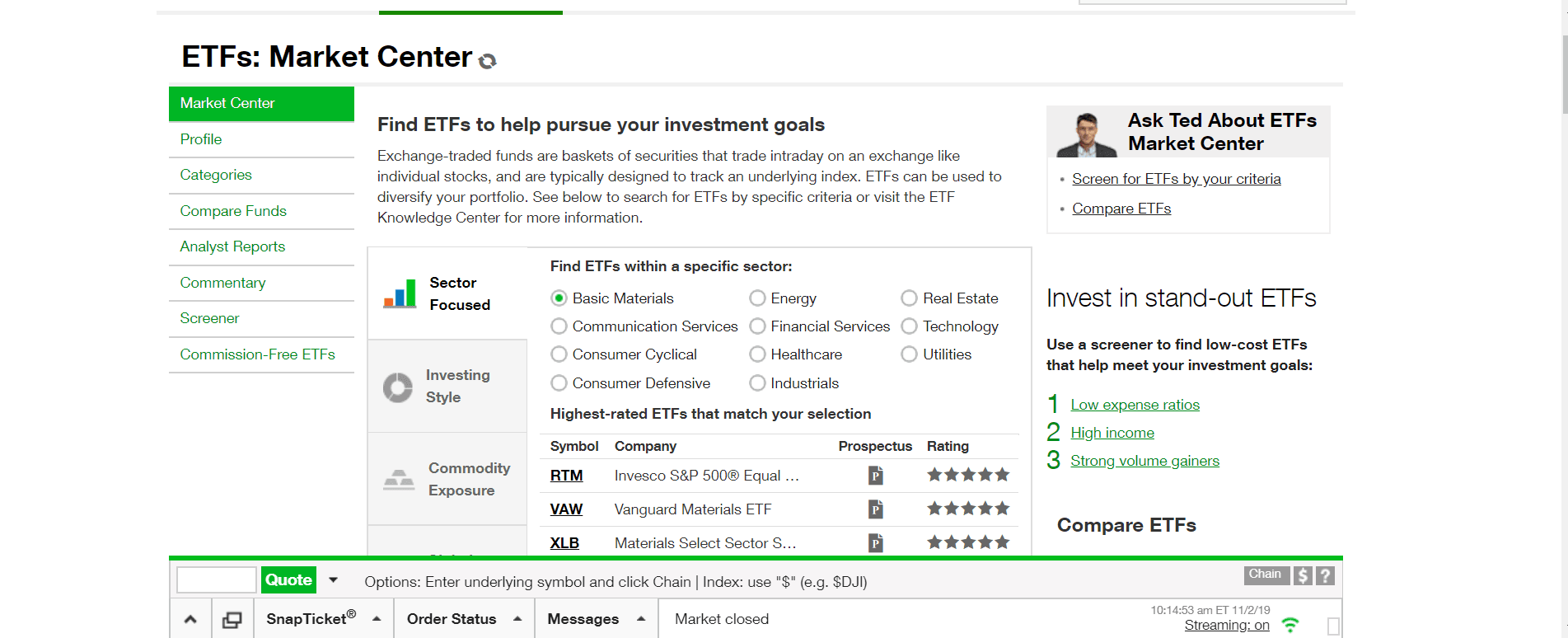

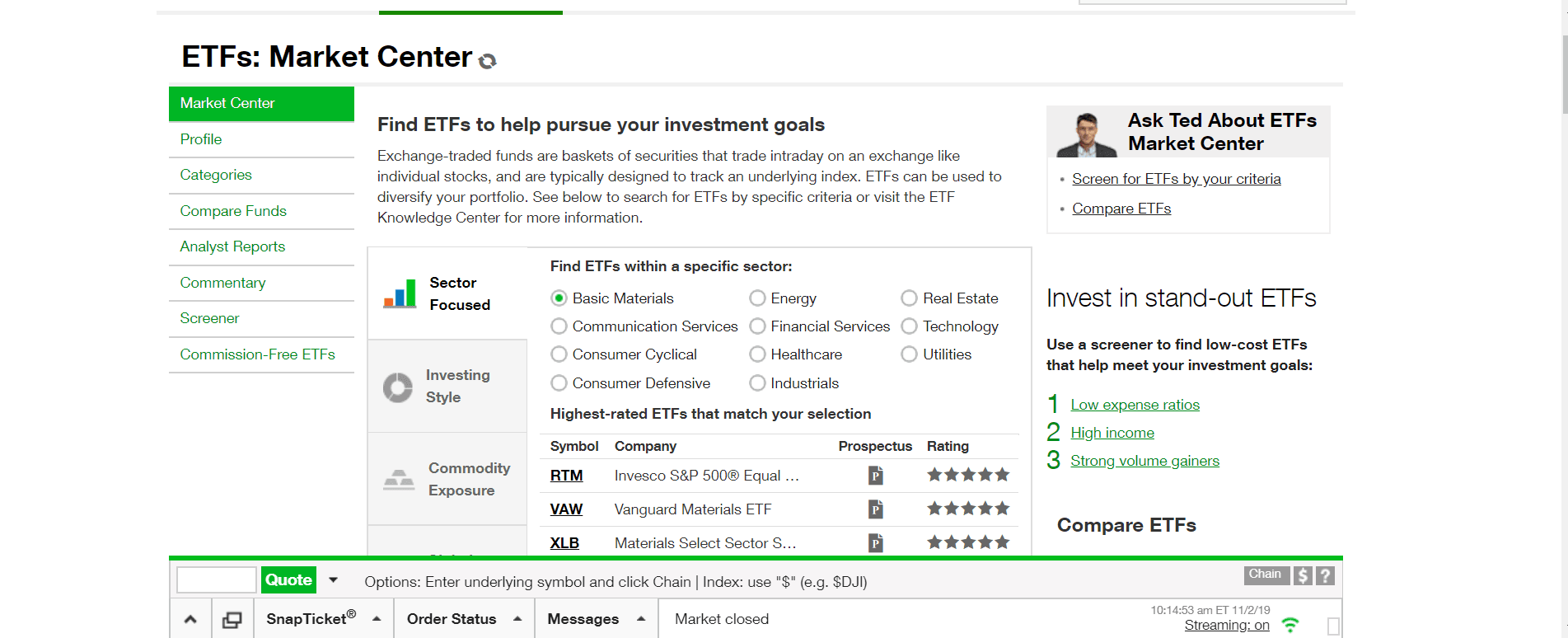

The wide variety of account types and investment options makes it easy to pursue multiple investing and savings goals while building one or more diversified portfolios. And new this year TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences so investors can stay up to date on market moves while driving. TD Ameritrade offer automatic investment plan or dollar cost averaging program is available for thousands of mutual funds for free.

There are no fees for trading US. While TD Ameritrade and its competitors both have low-cost or commission-free trades TD Ameritrade has a larger selection for investment products like mutual. The brokerage offers an automated investment account but youll need at.

TD Ameritrade also offers two trading platforms called Thinkorswim and Trade Architect. TD Ameritrades automatic investment plan is a form of dollar cost averaging and it enables you to gradually scale into positions in the 12000 mutual funds offered through the TD Ameritrade platform. 2021 TD Bank NA.

Both TD Ameritrade and Robinhood have 0 commissions on most stock and ETF trades. TD Ameritrade also offers several investment choices including no-transaction-fee mutual funds. The way you invest has changed thats why we offer managed portfolios.

Investing My HSA provider HSABank allows investment in TD Ameritrade and their no-commission ETFs. Thinkorswim is for professional traders while Trade Architect some users usually beginners might find more intuitive. Is there a way to setup automatic investing of the funds in TD Ameritrade.

TD Ameritrade is considered a safe broker since it has a long track record is listed on a stock exchange. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. However Robinhood doesnt charge a per-contract fee on options trades whereas TD Ameritrade customers pay 065 per options contract.

In the past when you wanted to make an investment you had to go to a broker pay a hefty fee and hope that they made a good recommendation for your portfolio. Exchange-listed stocks ETFs and options though there is a fee of 065 per option contract. It is regulated by top-tier authorities like the Securities and Exchange Commission SEC the Financial Industry Regulatory Authority FINRA and the Commodity Futures Trading Commission CFTC.

And for the more passive-minded investors TD Ameritrade offers two managed. TD Ameritrade Bonds Trading. Once you enroll in the program you can specify the dollar amount 50 minimum and frequency of each future automatic purchase.

The brokers pricing and minimums are competitive with other firms. Please read the Legal Disclaimers in conjunction with these pages. Because TDAIM and TD Ameritrade do not have trading authority for the Excluded Assets to the extent applicable to the nature of the Excluded Assets the client andor the other investment professional and not TDAIM or TD Ameritrade shall be exclusively responsible for directly implementing any recommendations relative to the Excluded Assets.

Td Ameritrade Review My Experience Using Td Ameritrade

Td Ameritrade Review My Experience Using Td Ameritrade

Betterment Smarter Investing Investing Investing Apps Cash Management

Betterment Smarter Investing Investing Investing Apps Cash Management

Td Ameritrade Review My Experience Using Td Ameritrade

Td Ameritrade Review My Experience Using Td Ameritrade

Td Ameritrade Review My Experience Using Td Ameritrade

Td Ameritrade Review My Experience Using Td Ameritrade

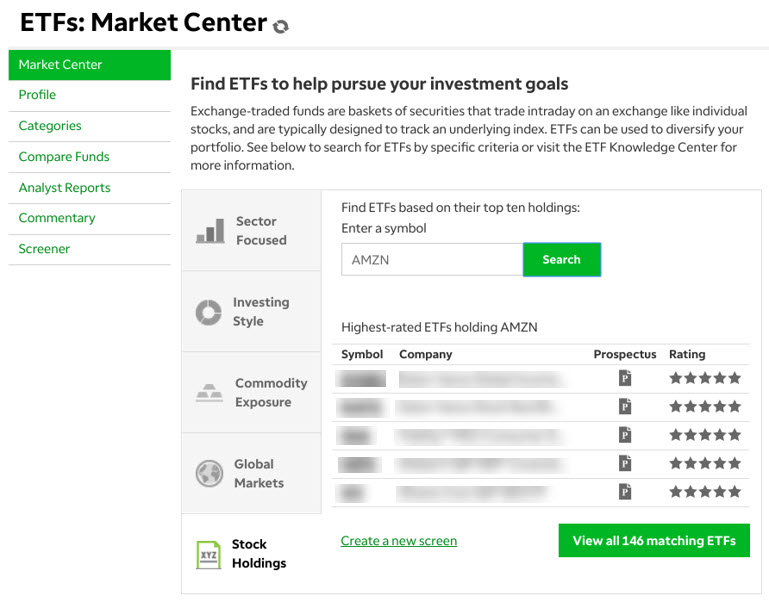

See Your Allocations From The Inside Out With Portfol Ticker Tape

See Your Allocations From The Inside Out With Portfol Ticker Tape

/Fidelityvs.TDAmeritrade-5c61be4546e0fb00017dd69a.png) Fidelity Investments Vs Td Ameritrade

Fidelity Investments Vs Td Ameritrade

Ways To Invest In High Priced Stocks Ticker Tape

Ways To Invest In High Priced Stocks Ticker Tape

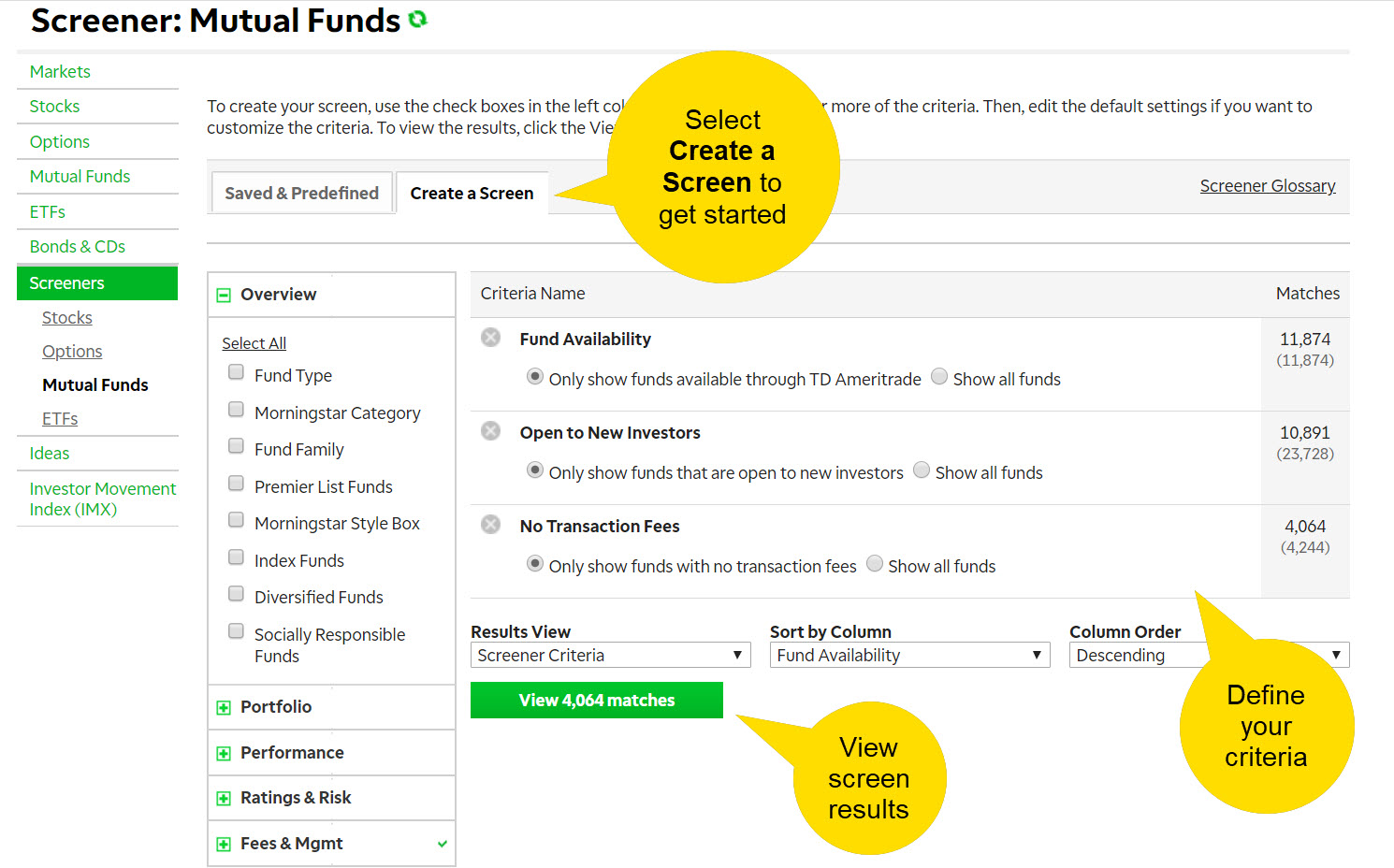

Pick And Choose How To Invest In Mutual Funds Ticker Tape

Pick And Choose How To Invest In Mutual Funds Ticker Tape

Automatic Investing W Etrade 3mins Investing Financial Literacy E Trade

Automatic Investing W Etrade 3mins Investing Financial Literacy E Trade

Retirement Investing Td Ameritrade

Td Ameritrade Essential Portfolios Review Smartasset Com

Td Ameritrade Essential Portfolios Review Smartasset Com

Robinhood Vs Td Ameritrade Which Is Best For Your Investments

Robinhood Vs Td Ameritrade Which Is Best For Your Investments

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Post a Comment for "Does Td Ameritrade Have Auto Invest"